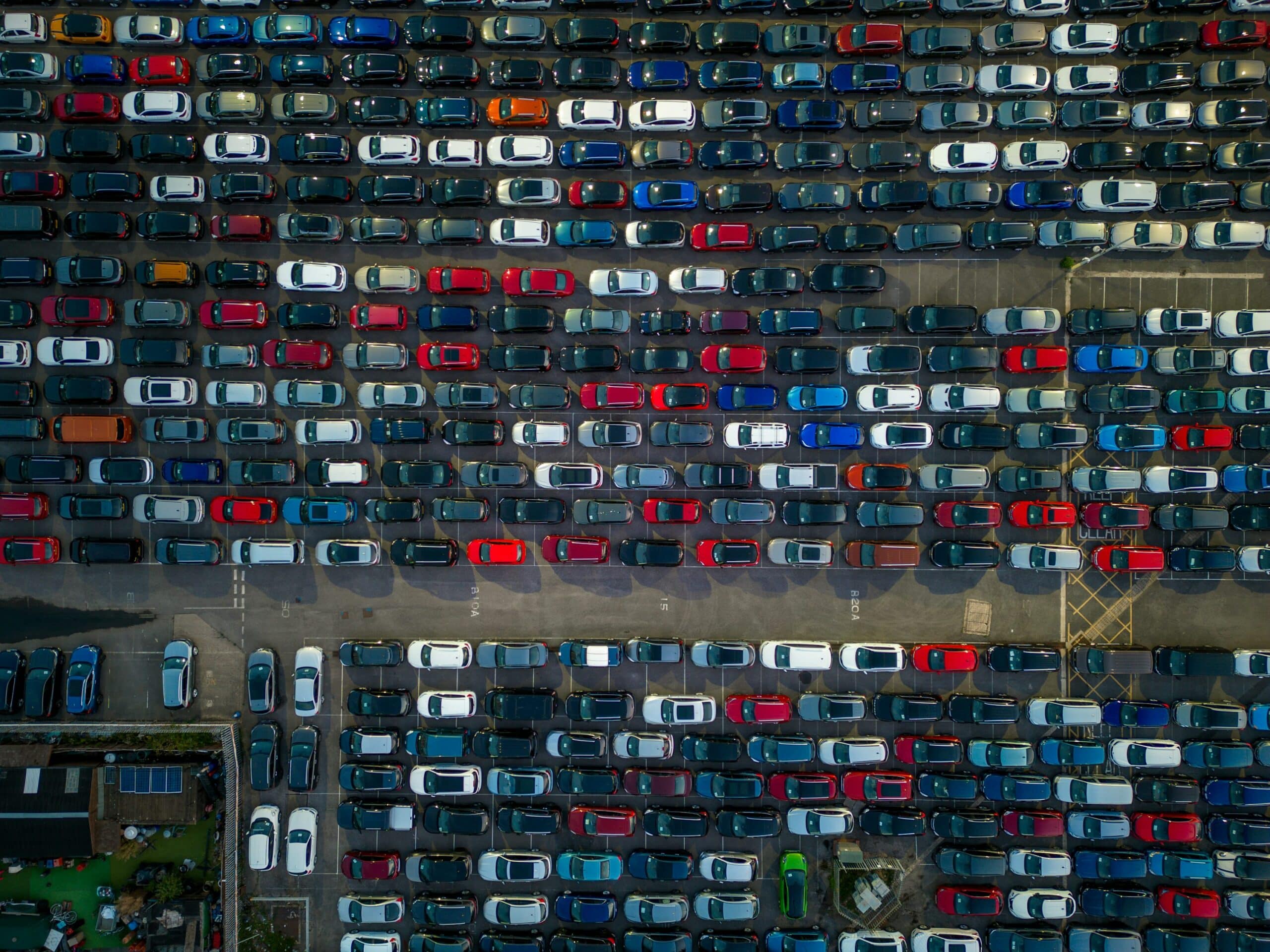

900,000 barrels.

U.S.- China ,Trump and Xi Jinping meeting the upcoming OPEC policy decision.

Light Crude Oil Futures are trading $60.21, up $0.06 or +0.10%

Expected Inventory Draws

Indicated sharper stock declines than anticipated. U.S. crude inventories reportedly fell by 4.02 million barrels last week.

Gasoline and Distillate stocks dropped 6.35 million and 4.36 million barrels.

WTI crude reversed higher at $60.17 earlier today, just above the 50% Fibonacci retracement zone of the recent rally from $56.11 to $62.59, which lies between $60.11 and $56.11. This zone now acts as a key support base.

Short term oil prices forecast is bearish, with near-term direction likely to be set by trader reaction within the $60.11–$57.12 retracement zone.