Two- wheeler sales surged from 6.14 lakh during Navratri 2024 to 8.35 lakh this year, marking a significant increase in festive demand.

India’s car market doesn’t offer many options, especially for cars above 1,500 cc. Many foreign brands, like Fords and Chevrolet, have reduced their presence or left the country completely.

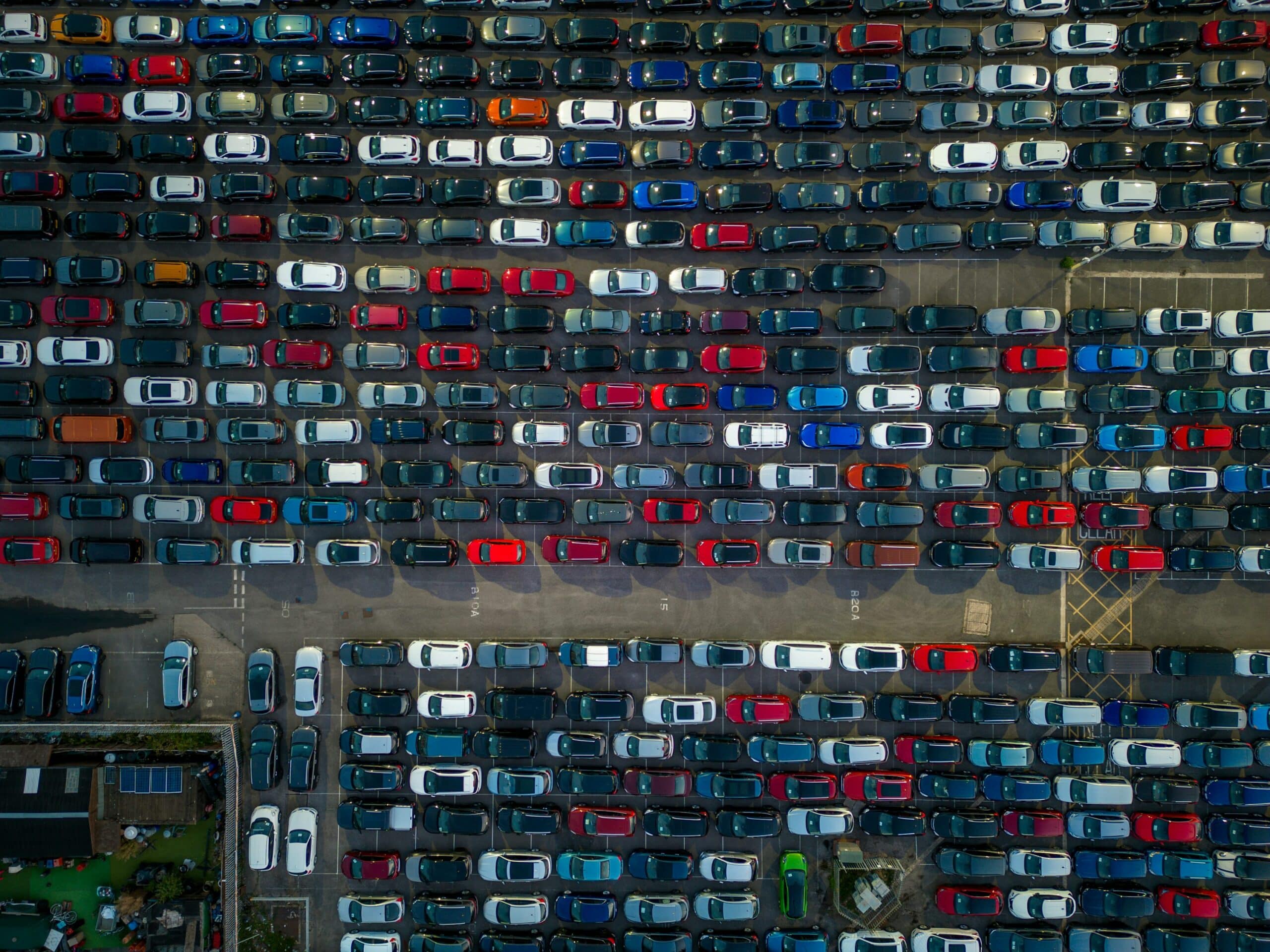

India’s auto industry, which had been experiencing subbed growth for some time, withnessed a sharp turnaround during this year’s Navratri festival. A 10 per cent reduction in gst significantly lowered vechicle prices drawing a surge of buyers to showrooms. As a result, sales of both two-wheelers and four-wheelers jumped by over 35 per cent compared to the previous Navratri.

Two- wheeler sales rose from 6.14 lakh units in 2024 to 8.35 lakh units this year. Passenger vehicle sales saw a 35 per cent increase, climbing from 1.61 to 2.18 lakh units. commercial vehicle sales also registered 15 per cent rise, from 29,481 units to 33,856. Meanwhile, tractor sales grew by 19 per cent year-on- year.

| Category | Navratri | Navratri 25 | YoY% |

| 2-Wheelers | 61.14 Lakh | 8.35 | 36% |

| 3-Wheelers | 0.37 | 0.46 | 35% |

| Tractors | 0.18 | 0.22 | 25% |

| Commercial Vehicles | 0.29 | 0.34 | 19% |

| Passenger Vehicles | 1.61 | 2.18 | 15% |

| Total | 8.63 | 11.57 | 34% |

For the first time dealerships across the country witnessed record-breaking footfalls and deliveries, with overall retail rising by 34 per cent year-on-year. A historic high for any festive season, said Sai Giridhar, buyer confidence are expected to carry forward with even greater momentum into Dhanteras, Diwali, and beyond.

Among two- wheeler manufacturers, Here Motocorp and Royal Enfield reccorded the highest gains in market share in september 2025. In contract, Honda and Bajaj saw a decline. In the passenger vehicle segment, Tata Motors and Maruti Suzuki posted the strongest growth in market share, while Hyundai Motor and Toyota experienced a dip.

India’s car market currently offers limited choices, especially in the above 1,500-cc segment. Several foreign automakers, including Ford and Chevrolet, have either scaled down operations or exited the country altogether. This trend has been driven by the factors such as low profit margin, regulatory challengers, and high taxation. However, recent policy changes are expected to encourage these brands to reconsider their stance, potentially brings a wider range of options to Indian consumers.